Family Business Succession Planning Uk

We never forget that balancing business and family interests can be a juggling act.

Family business succession planning uk. Business succession planning is critical. That s despite the fact that nearly two thirds of this cohort will hit retirement age in the next decade. But business continuation can prove a problem for many. From tax advice and setting up trusts to raising capital and succession planning we can provide practical and invaluable advice as your business and family grow.

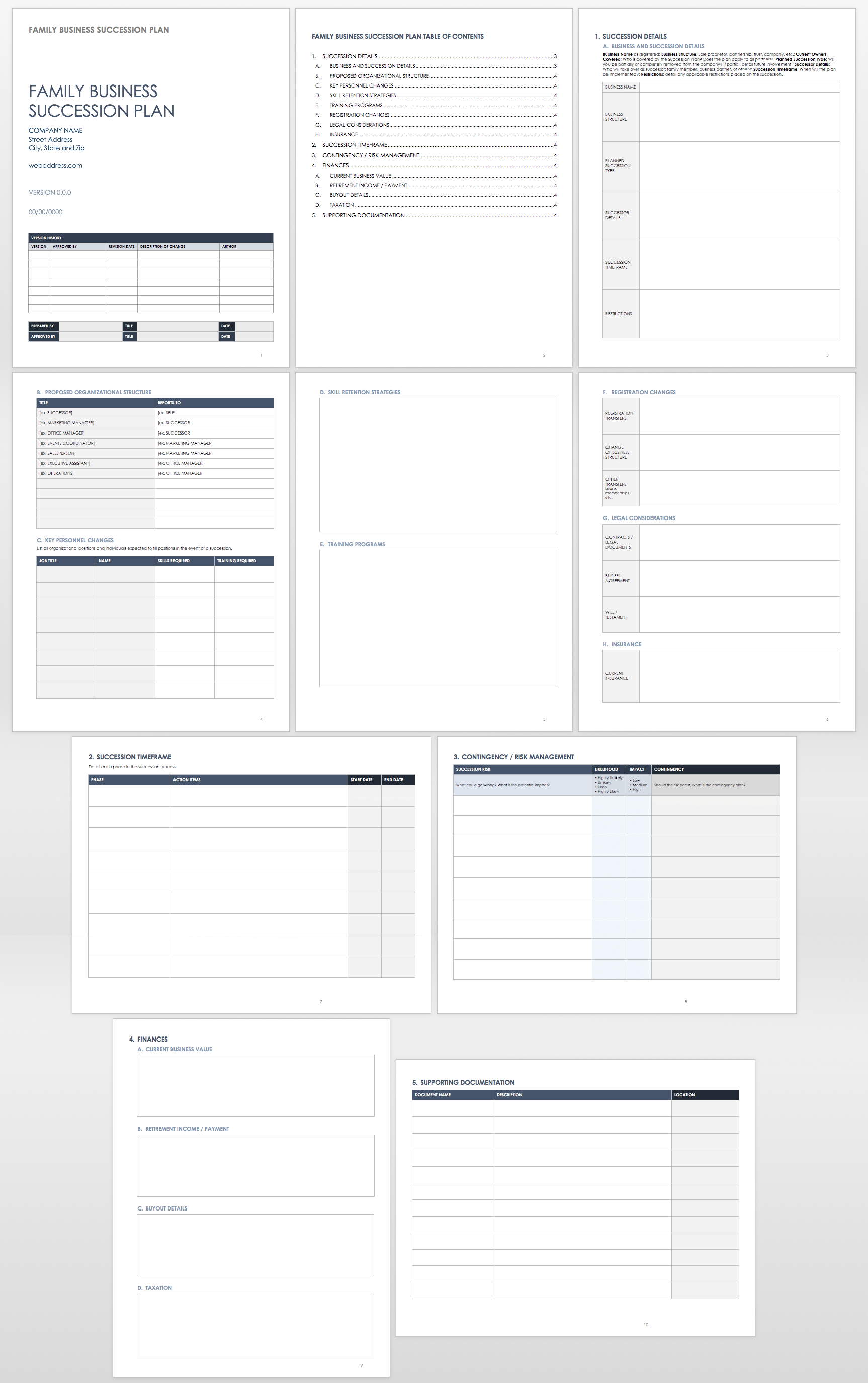

Our succession planning template helps business owners as they answer questions like who will take over the business how long will it take and what standard operating procedures need to be passed on. Planning succession institute for family business. Bridging the strategy gap in u s. Family run businesses are everywhere from plumbing and electrical specialists to automotive dealers and accountancy firms.

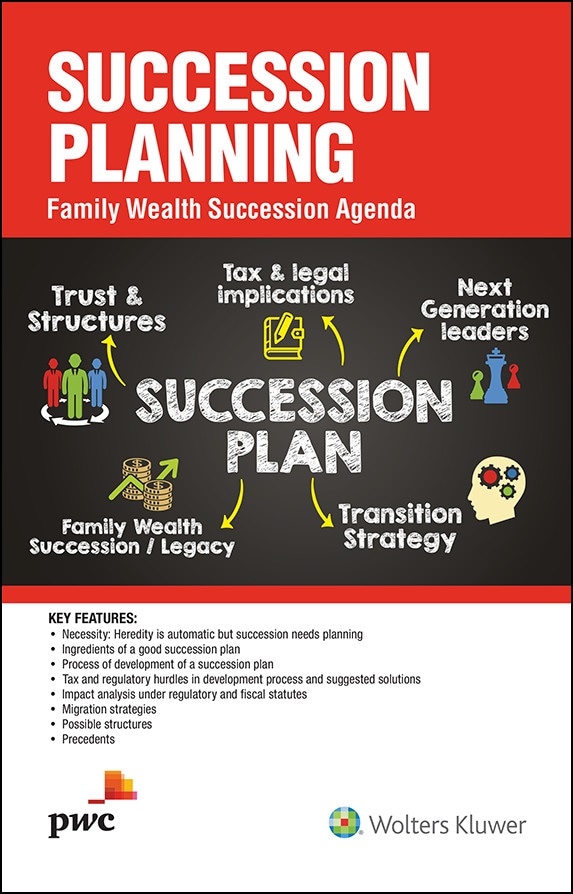

The matter of succession planning is something that gets a lot of focus from family businesses and for good reason it is one of the hardest things for both the business and the family to go through. Succession planning is not simply a changing of the guard. Based on our experience of advising countless family business over the years this article shares a few tips at how to start the discussion and get it right. According to pwc s 2017 family business survey just 13 per cent of family business owners have a robust documented and communicated succession plan in place.

They re an essential part of the british marketplace and long may they continue. Balancing family and business needs to draw up a fair effective and tax efficient exit strategy succession planning in family businesses nibusinessinfo co uk skip to main content. A business succession plan includes step by step instructions that establish procedures in the event a business owner or key employee leaves the business. 58 per cent of family run businesses in the uk do not have any form of succession plans in place according to legal general.

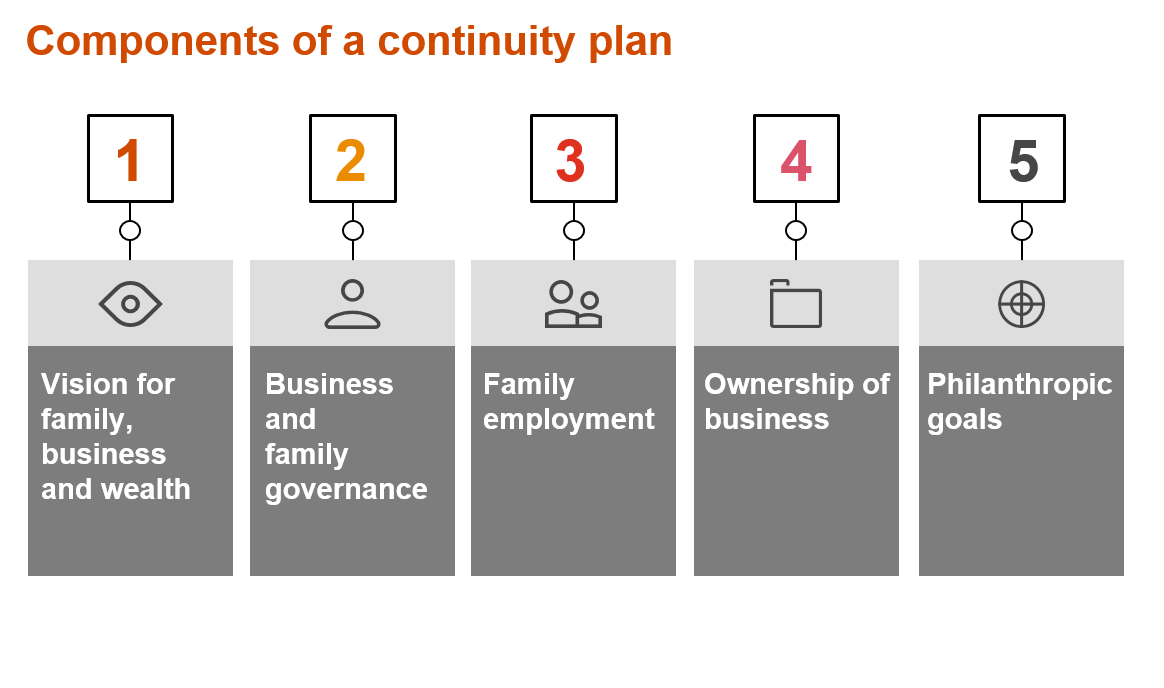

Succession planning for a family business the transition of a closely held or family owned business is an important event for such clients and must be planned for accordingly. Succession planning is a perennial problem for family businesses a 2017 report from pwc called the missing middle. Recent changes to the tax landscape have caused the succession planning strategy to be re evaluated resulting in the need for highly skilled advisors adept in planning.