Free Living Trust Forms Illinois

If you are wed and contemplating establishing a trust for estate preparation objectives one of the very first things you will really need to figure out is whether to set up a joint living trust or separate.

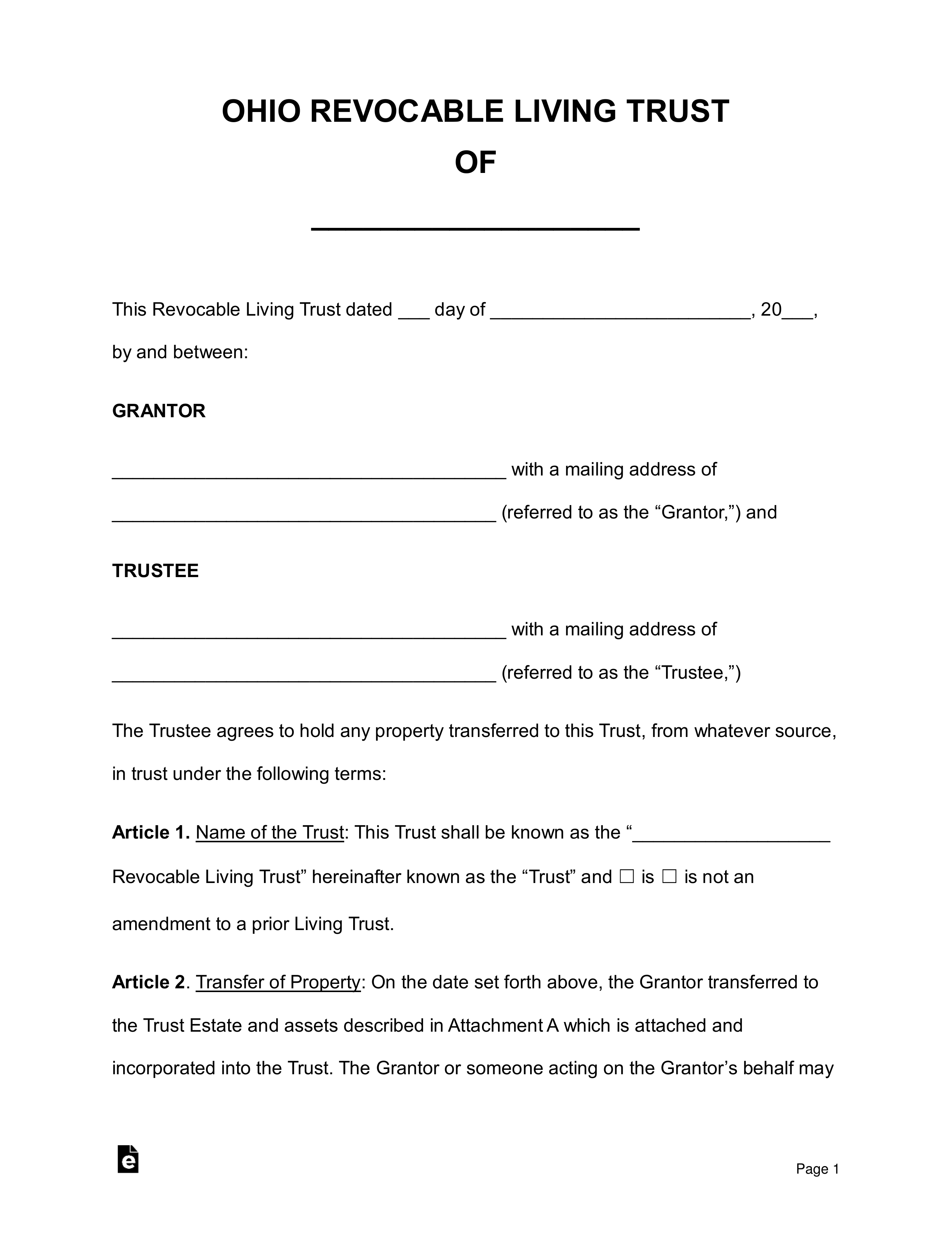

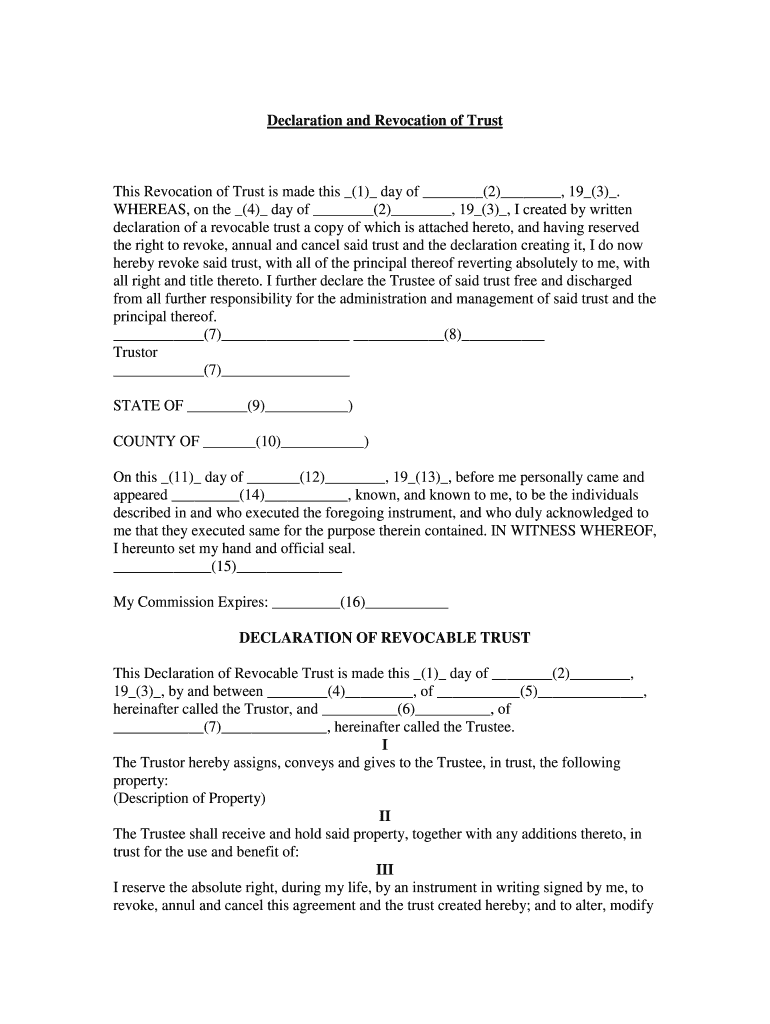

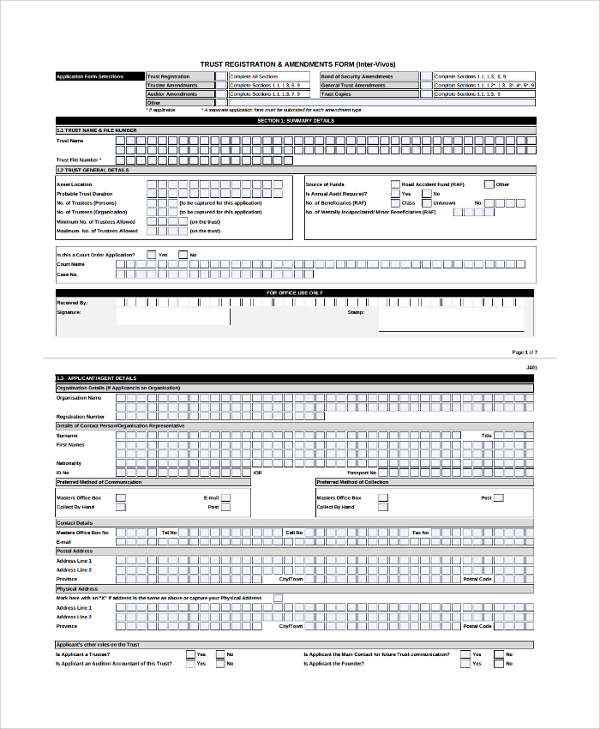

Free living trust forms illinois. An illinois living trust form is a legal document that is drafted to transfer a person s assets on to their named beneficiaries upon death. Download free living trust forms online fast. Download a living trust also known as a inter vivos trust that allows an individual the grantor to gift assets and or property during the course of their life to another individual the beneficiary the trustee will be in charge of handling the property even though it belongs to the beneficiary. The grantor maintains ownership over their assets and they can make alterations to the document or choose to revoke the trust at any point in their lifetime.

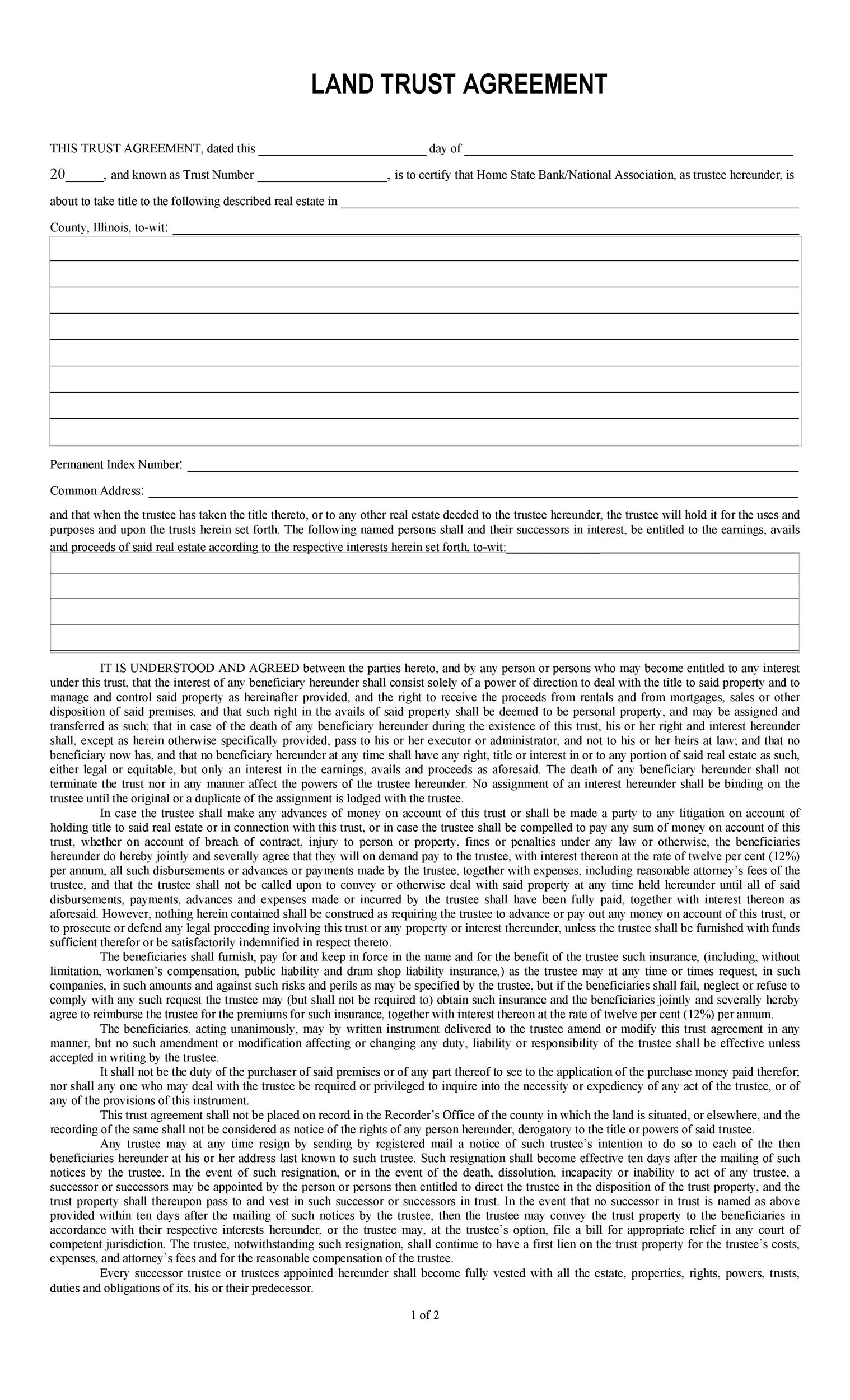

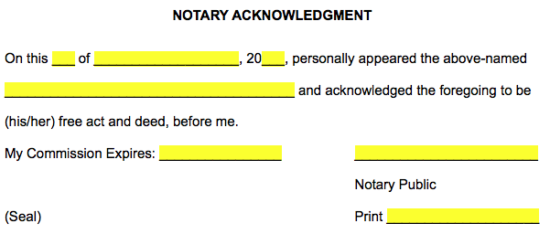

Download the illinois living trust that allows a person called a grantor to set aside assets and property into a separate entity by which he or she can specify how when and to whom the property and assets are distributed. Aside from avoiding probate the grantor person who establishes the trust has continued access to their assets if they become incapacitated in any way. Our free illinois living trust forms are very popular estate planning tools that can be utilized to avoid probate and court supervision of your assets. The deed should be signed and recorded in the local recorder office where the real property is located.

Living trusts are well known estate planning devices for families. A living trust is a document that allows individual s or grantor to place their assets to the benefit of someone else at their death or incapacitation. An illinois living trust is a document that allows the recipient s of a deceased individual s assets to avoid the court supervised probate process implemented after a person dies the initial creator of the trust referred to as the grantor will transfer property and assets to the trust and outline specific instructions for what shall be done with said property and assets when they die. A living trust is a legal form devised and drafted to transfer a person s assets to designated beneficiaries when that person dies.

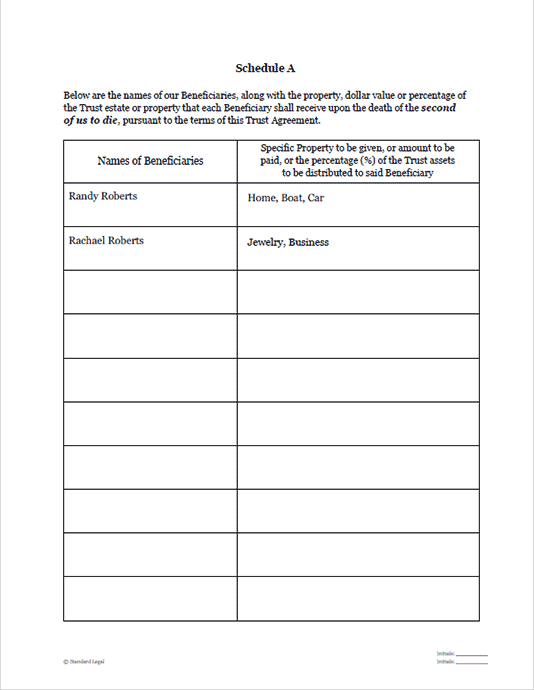

Therefore the person that is selected as the successor trustee will oversee that all the property in the trust will transfer to the beneficiary at the time. To add real estate to a living trust the grantor s of the trust create a real property deed with the living trust named as grantee. Unlike a will this document is created during the course of the grantor s. For instance a grantor can decide that he or she doesn t want the beneficiary to receive the assets or property until they have reached a certain age.

The joint living trust form can be employed to institute a trust that can be cancelled or revoked by the grantor or grantors at any time. A living trust is designed especially for the survivors to avoid probate.